Configure VAT and Collect VAT IDs for Europe

You can configure WHMCS to charge Value-Added Tax (VAT) on purchases and collect VAT IDs from clients on the order form.

WHMCS cannot provide tax advice or substitute for a tax expert. We recommend seeking appropriate advice from your local tax authorities.

Configure Tax Rules for VAT

To configure WHMCS to collect VAT:

1. Go to your tax configuration.

Log in to the WHMCS Admin Area and go to Configuration () > System Settings > Tax Configuration.

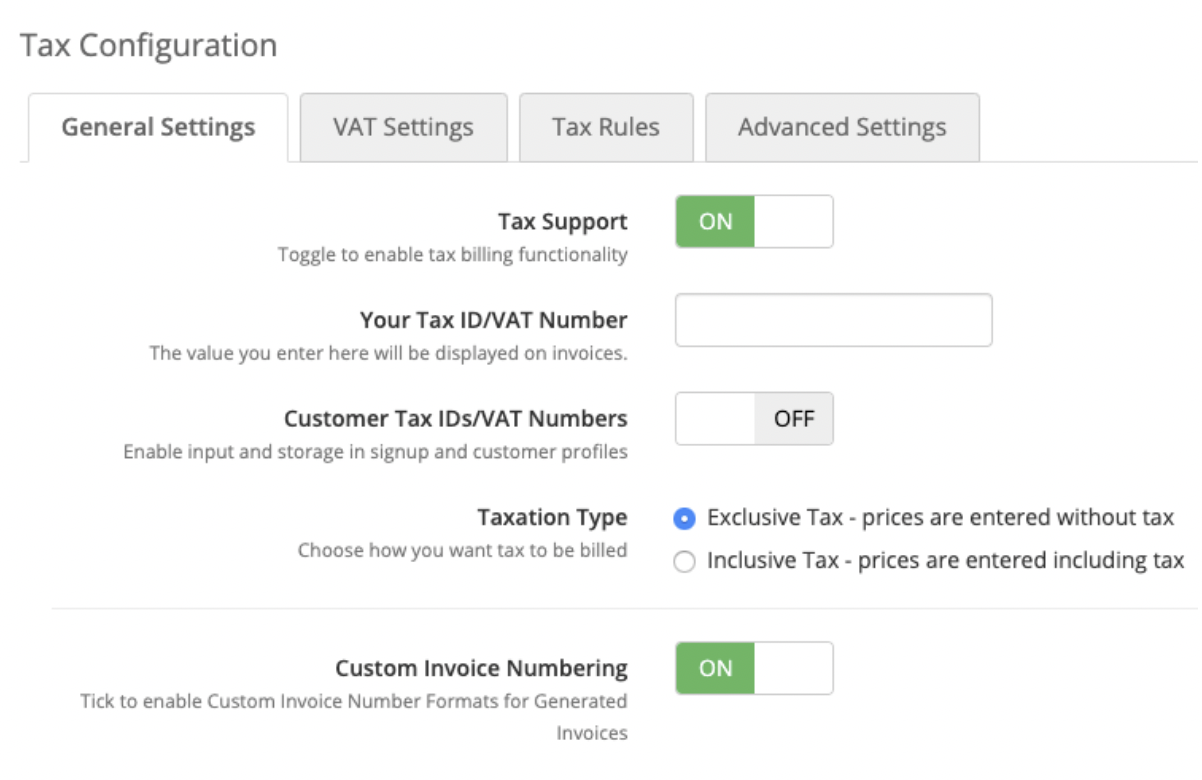

2. Enable tax support.

Set Tax Support to ON.

3. Enter your VAT ID number.

To display your own VAT ID on invoices, enter it for Your Tax ID/VAT Number.

4. Enable customer VAT numbers.

Set Customer Tax IDs/VAT Numbers to ON.

5. Save your changes.

Click Save Changes.

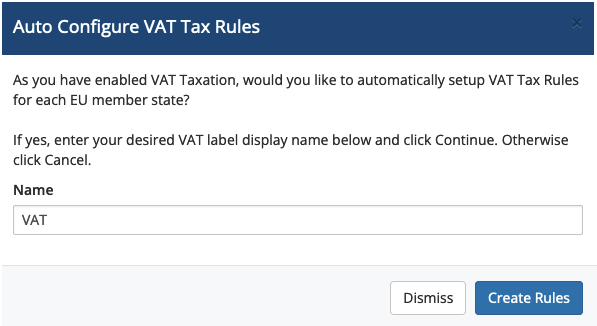

6. Enable VAT Mode.

Select the VAT Settings tab, and then set VAT Mode to ON.

7. Enter a VAT label display name.

For Name, enter the VAT label display name that you want to use, and then click Create Rules.

8. Select the taxed items and products.

Choose the items and products to tax using this configuration.

For more information, see Tax Configuration.

Last modified: 2025 July 28