Configure GST and Collect GSTINs for India

You can configure WHMCS to charge GST on purchases and collect GSTINs from clients on the order form.

WHMCS cannot provide tax advice or substitute for a tax expert. We recommend seeking appropriate advice from your local tax and GST authorities.

Configure Tax Rules for GST

To configure WHMCS to collect GST:

- Log in to the WHMCS Admin Area.

- Go to Configuration () > System Settings > Tax Configuration.

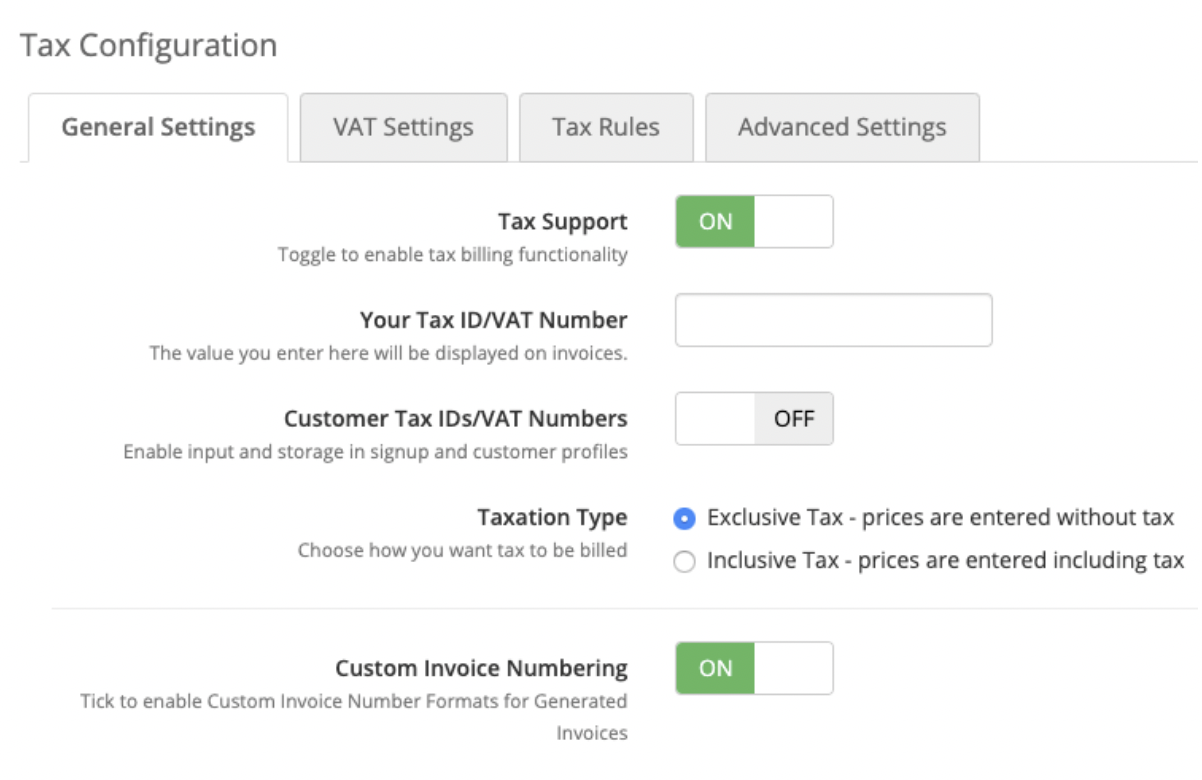

- Set Tax Support to ON.

- To display your own GSTIN on invoices, enter it for Your Tax ID/VAT Number.

- Set Customer Tax IDs/VAT Numbers to ON.

- Click Save Changes.

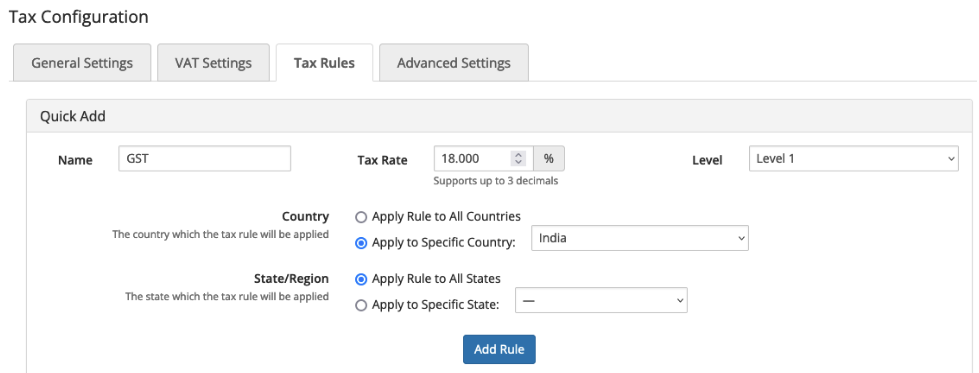

- Select the Tax Rules tab.

- Under Quick Add, create the desired

GSTtax rules. Tax rules can apply to an entire country or to individual states or regions.- For example, you could create a

GSTrule that applies to all of the states or regions in India:

- After you configure the settings for each tax rule, click Add Rule. Repeat the process for each desired tax rule.

- For example, you could create a

- Choose the items and products to tax using this configuration.For more information, see Tax Configuration.

Customize the Tax ID Label for GSTIN

You can customize the label for collecting tax ID numbers to display GSTIN instead of Tax ID.

On WHMCS Cloud

- You must activate the Translation Editor addon module before you can use it for the first time.

- The Translation Editor addon module is an exclusive addon module for WHMCS Cloud.

To do this on WHMCS Cloud:

- Go to Addons > Translation Editor.

- For Language (locale), choose the desired language or locale.

- Search for

taxLabel. - Click in the Custom (Override) Value column.

- Enter

GSTIN. - Click the checkmark icon to save the override.

On Self-Hosted WHMCS Installations

To do this for a self-hosted WHMCS installation:

- Create an

overridesdirectory in thelangdirectory within your WHMCS installation. - Create an override file for the desired language within the new

overridesdirectory (for example,/whmcs/lang/overrides/english.php). - Enter the following content for the file:

<?php $_LANG['tax']['taxLabel'] = "GSTIN"; - Save the file. The system will now display GSTIN as the display label.

For more information about customizing language strings in WHMCS, see Customize Text.

Last modified: 2025 November 27